Non-Homestead Millage Information

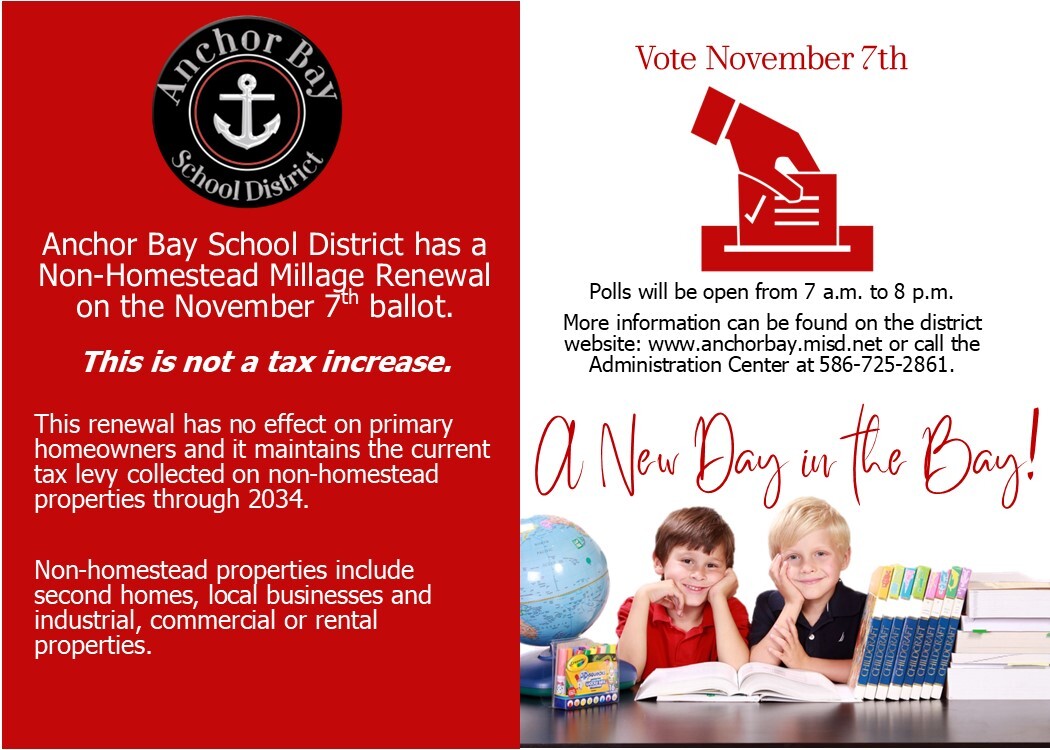

Anchor Bay School District has a Non-Homestead Millage Renewal on the November 7th ballot. This is not a tax increase. It has no effect on primary homeowners. It maintains the current tax levy collected on non-homestead properties through 2034.

Why is Anchor Bay School District seeking this millage renewal?

As a result of Michigan’s school funding structure detailed in Proposal A, districts are required to collect 18 mills on non-homestead properties locally for the district to receive its full per-pupil foundation amount from the State.

By law the District may only levy 18 mills for the Non-Homestead Millage. The ballot language includes an additional .9687 mills that will be held back as a hedge against future Headlee rollbacks. This is not a tax increase. Non-homesteads will continue to pay the same 18 mills.

Why be prepared for a rollback?

The Headlee Amendment to the Michigan Constitution states that a rollback must occur when the growth on existing property is greater than the rate of inflation. The last rollback for Anchor Bay was in 2019, and the district had to do a millage restoration to keep our full funding. By having the additional .9687 approved during the renewal, it keeps the levied amount at 18 mills if a Headlee rollback were to happen in the next 10 years. This avoids having to go to the voters for additional restorations and allows the school district to receive its full per-pupil foundation amount from the State.

The first day of school is August 27th. It is a half day for all students.

The first day of school is August 27th. It is a half day for all students. We are asking parents to verify/update their student information through the PowerSchool Parent Portal. Please complete the Returning Student Annual Update forms no later than September 15,2025. These forms are located in the Parent Portal under Forms in the left navigation window, and then under the General Forms tab. The forms included in the update are:

We are asking parents to verify/update their student information through the PowerSchool Parent Portal. Please complete the Returning Student Annual Update forms no later than September 15,2025. These forms are located in the Parent Portal under Forms in the left navigation window, and then under the General Forms tab. The forms included in the update are: